By Irene Mugua, Assistant Manager, Business Development

Dividends are known as one of the ways investors earn a return from investing in stocks. Dividends are regular payments of profit made to investors who own a company’s stock. Companies pay dividends to reward shareholders for their investments and continued support, and to investors dividend payouts are often seen as a sign of a company’s financial health and management’s confidence in future cash flow. Dividends can also communicate a positive message to investors who perceive a long-term dividend as a sign of corporate maturity and strength. Not all company however pay dividends but where companies do not pay dividends there is usually communications on the reasons so as to avert investor loss of confidence in the company.

Top tier banks in Kenya listed at the Nairobi Securities Exchange (NSE) announced commendable dividends from their 2022 financial results and shareholders of these public listed banks are expecting good returns on their investment, as we can see below: –

| DIVIDEND YIELDS OF TOP TIER BANKS LISTED AT THE NAIROBI SECURITIES EXCHANGE (NSE) – 2022 | |||

| COMPANY | DIVIDEND PER SHARE | CURRENT PRICE | DIVIDEND YIELD |

| Standard Chartered Bank Kenya Ltd | 22.00 | 142.00 | 15.49% |

| I&M Holdings Plc | 2.25 | 16.90 | 13.31% |

| ABSA Bank Kenya Plc | 1.35 | 10.50 | 12.86% |

| NCBA Group Plc | 4.25 | 35.00 | 12.14% |

| Co-operative Bank of Kenya Ltd | 1.50 | 12.75 | 11.76% |

| Stanbic Holdings Plc | 12.60 | 117.75 | 10.70% |

| Diamond Trust Bank Kenya Ltd | 5.00 | 52.25 | 9.57% |

| Equity Group Holdings Plc | 4.00 | 44.95 | 8.90% |

| KCB Group Plc | 2.00 | 31.20 | 6.41% |

These payouts can be a good source of passive income, but there is more to these dividends than just cash in your pocket. When a shareholder elects to reinvest the dividends, the money from the dividend payment is used to purchase more shares in the same company. The process of reinvesting dividends is quite simple and an investor can opt to do this manually as part of their investment strategy.

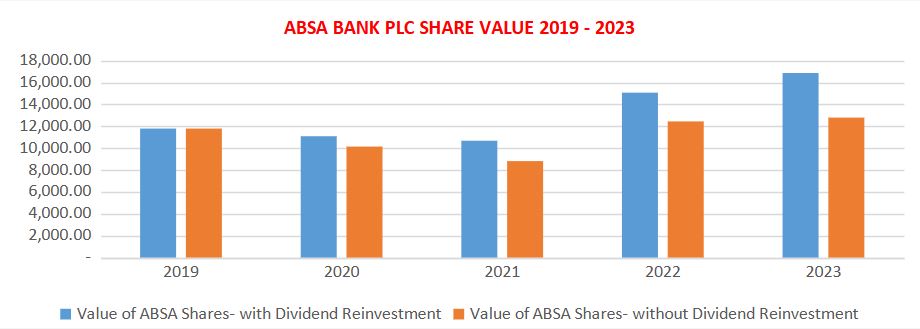

Before we continue to the pros and cons of dividend reinvestment, here is an example of dividend reinvestment for ABSA Bank Kenya PLC for the last 5 years where an investor with a shareholding of 1,000 shares has been ploughing back the dividend payout to buy more shares. We have analyzed the value of shares over the 5-year time period with & without reinvesting the dividends paid for example purposes.

| Dividend Reinvestment example, Company ABSA Bank Kenya PLC | |||||

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Number of Shares | 1000 | 1093 | 1211 | 1211 | 1318 |

| Stock Price | 11.8 | 10.15 | 8.82 | 12.45 | 12.8 |

| Dividend Per Share | 1.1 | 1.1 | 0 | 1.1 | 1.35 |

| New Shares from Dividend Reinvestment | 93 | 118 | 0 | 107 | 139 |

| Value of ABSA Shares- with Dividend Reinvestment | 11,800.00 | 11,093.95 | 10,681.02 | 15,076.95 | 16,870.40 |

| Value of ABSA Shares- without Dividend Reinvestment | 11,800.00 | 10,150.00 | 8,820.00 | 12,450.00 | 12,800.00 |

**This is an example only, dividends from shares are not guaranteed and the value of shares can go up or down due to market effects. These calculations do not account for charges or taxes. This Information purposes only and is not to be taken as a specific stock recommendation.

The question every investor should ask is whether to take the cash dividend or reinvest their dividends in the same company or buy shares in another company . Some of the notable advantages of dividend reinvestment includes:

- You get more shares of a stock on a regular basis without further spending, as you are using passive income already earned on your investment.

- If you reinvest dividends, you can supercharge your long-term returns because of the power of compounding. Your dividends buy more shares, which increases your dividend payout the next time, which lets you buy even more shares, and so on.

- When you reinvest your dividends, you are taking advantage of a powerful investment strategy called dollar-cost averaging. By consistently reinvesting, you purchase more shares when prices are low and fewer when prices are high. This smooths out the cost of your investments over time, reducing the impact of market volatility on your portfolio.

- It offers the ability to grow your wealth quietly and steadily.

- Reinvesting dividends encourages discipline in your investment strategy. By consistently reinvesting, you create a habit of thinking long-term and focusing on growth rather than immediate gains. This disciplined approach can help you stay the course during market fluctuations and keep you on track to achieve your financial goals.

If you examine your returns 10 or 20 years later, reinvesting is more likely to increase the value of your investment than simply taking the cash. This is because dividend reinvestment boosts the annualized returns of a portfolio and those returns compound over time.

Every coin has two sides and to point out the reasons why you should not reinvest your dividends, you should consider: when you need the money to supplement your current income; when the stock is under performing then you should take the cash.

Banks will start paying dividends as from the 25th May, 2023. Reach out to us and take advantage to opt in to receive your money by Mpesa, thus ensuring you promptly receive your dividends and are able to make quick reinvestment decision.

Alternatively, dial *483*038# to opt in for Mpesa dividend payment mode and instantly receive your dividend payment via Mpesa on every payment date.

No comment