Introduction:

In the realm of corporate governance, AGMs serve as pivotal forums for companies to interact with shareholders. It is important therefore the AGMs provide a good representation of shareholders across all demographics. However, this was not the case for physical AGM’s. A 2019 research conducted by C&R Group, which analyzed AGM attendance data from 2015 to 2019, highlighted a lack of representation from mid-tier shareholders. In 2019, hybrid AGMs was emerging in the US and UK, and C&R put forward the hypothesis that adopting hybrid AGM’s would help in facilitating representation from missing shareholder demographics, by reducing the time and geographical constraints of attending physical AGM’s. Read more

This was indeed the result when, coming out of the Covid-19 pandemic which forced technological transformations across all industries, AGMs transformed to virtual and hybrid formats. The change to virtual and hybrid AGM’s democratized access to AGMs, enabling more active participation from shareholders of diverse backgrounds and locations. To understand the impact of the transformational impact of virtual or physical AGM’s, C&R Group conducted a comprehensive review of AGM attendance data from 2020 to 2023 so as to compare against the 2019 findings. The analysis covered companies of various sizes, focusing on attendance percentages relative to the total register. The average number of shareholders per company was also considered to gauge the impact of size on engagement dynamics.

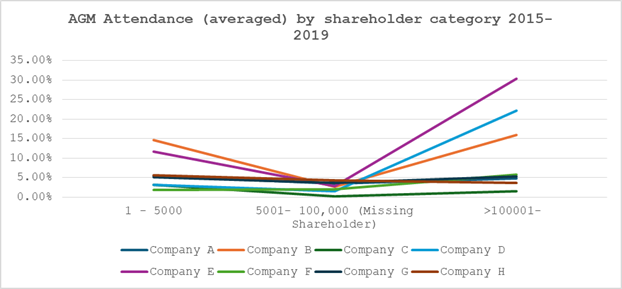

Our initial study in 2019 revealed a consistent under-representation of shareholders in the 5001-100,000 shareholding category at AGMs, raising questions about their engagement and participation. See below graphical representation:

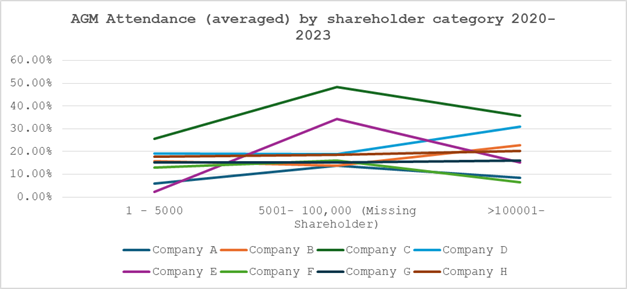

However, in the post-COVID era, with the adoption of virtual and hybrid AGM’s, we have observed a remarkable uptick in attendance from this demographic, signaling a potential paradigm shift in shareholder dynamics. This surge in participation can be attributed to several factors, including the widespread adoption of digital communication tools, the normalization of remote participation, and the convenience afforded by virtual and hybrid AGM formats.

Further analysis underscores the positive response of this shareholder category to the new AGM formats. With physical AGM’s, spanning from 2015 to 2019, the average attendance of shareholders holding 5,001 to 100,000 shares at physical AGMs stood at 4.14%. However, with the virtual and hybrid AGM formats, from 2020 to 2023, attendance of this shareholder demographic surged to 14.52%.

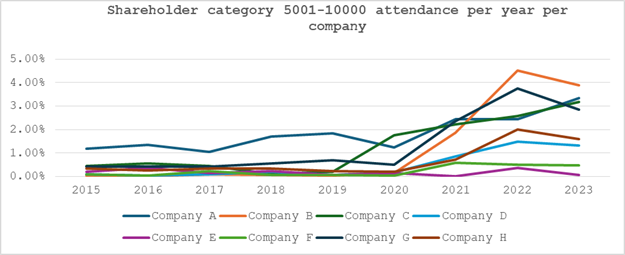

Notably, the surge in attendance from shareholders holding 5,001 to 100,000 shares in 2021, particularly in smaller sized companies, shows that there is interest in AGM participation from this shareholder category. This is beneficial to companies as these shareholders represent the middle and upper middle class, who are an important category for having a stable local investor base.

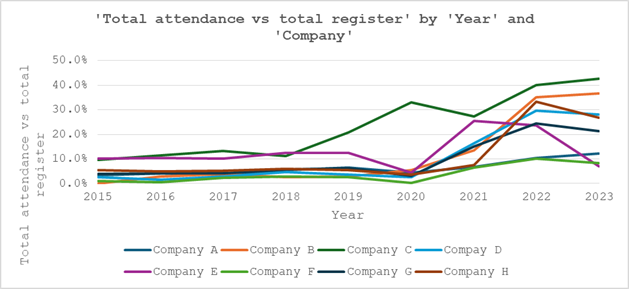

Moreover the shift to virtual AGMs has positively impacted overall AGM attendance representation, not just for the middle-tier shareholder demographic.

One of the key advantages of virtual/ hybrid AGMs lies in their ability to cater to the needs of busy professionals and active investors, who often find it challenging to attend traditional AGMs due to conflicting schedules or logistical constraints. By offering an online platform for registration, attendance, and participation, companies can have better overall participation, resulting in a wider range of valuable insights and perspectives of these shareholders, thereby enriching the dialogue between management and investors. Our research on the total attendance vs the total register from 2015 to date showed an increased participation from 2020 to date:

When considering company size, distinct trends in AGM attendance emerge. Big-sized companies like Company A and F maintain moderate to high attendance rates, indicating sustained shareholder engagement. Mid-sized firms such as Company G and H exhibit varied attendance, with some years experiencing peaks, possibly due to targeted engagement initiatives. Small-sized companies, including Company B, C, D, and E, demonstrate fluctuating attendance, with occasional increases but overall inconsistency. Compared to larger counterparts, small-sized companies consistently show lower and less stable attendance, suggesting a need for enhanced shareholder engagement strategies.

Why companies should embrace Virtual or Hybrid AGM formats.

Virtual or Hybrid AGMs empower shareholders with greater flexibility and convenience for participation, allowing them to engage with company updates, presentations, and discussions at their own pace and convenience. Whether attending in person or participating virtually, shareholders can contribute to the discourse on strategic initiatives, governance matters, and financial performance, thereby fostering a culture of transparency and collaboration.

Insights into Shareholder Engagement Trends:

Key Findings from the Analysis

- Shift Towards Virtual Engagement: The analysis unveiled significant positive benefits of virtual AGMs. Companies increasingly leveraged digital platforms to conduct AGMs, resulting in a notable surge in virtual attendance as shareholders embraced remote participation opportunities.

- Impact of Company Size: Company size emerged as a crucial determinant of AGM attendance trends. Large-sized companies, exemplified by Company A and Company F, consistently demonstrated higher attendance rates, indicative of robust engagement strategies and broader investor interest. Mid-sized companies like Company G and Company H also experienced positive engagement trends, although with some fluctuations. In contrast, smaller companies exhibited more varied participation levels, highlighting the importance of tailored engagement approaches to address their unique shareholder dynamics.

- Leveraging Technology for Engagement: The analysis underscored the increasing importance of leveraging technology to facilitate shareholder engagement. Virtual AGMs not only provided a solution to the challenges posed by the pandemic but also offered enhanced accessibility and convenience for shareholders. Companies that embraced digital platforms for AGM proceedings demonstrated a commitment to adapting to evolving shareholder preferences and maximizing engagement opportunities.

- Importance of Active Shareholder Outreach: Proactive shareholder outreach emerged as a key strategy for driving AGM participation. Companies that engaged in targeted communication efforts, including personalized invitations, reminder notifications, and educational materials, were successful in encouraging shareholder attendance and fostering a sense of inclusion and participation among stakeholders.

Implications and Recommendations:

In conclusion, analyzing AGM attendance data from 2020 to 2023 reveals the evolving landscape of shareholder engagement. The findings show that companies must recognize and respond to changes in how shareholders want to engage with them, particularly during AGMs. As shareholder preferences evolve, driven by factors such as technological advancements, changing demographics, and shifts in corporate governance expectations, companies must adjust their approach to ensure effective communication and meaningful participation. Furthermore, companies should prioritize transparent communication, proactive investor relations efforts, and tailored engagement initiatives to cultivate meaningful relationships with shareholders and strengthen corporate governance practices.

As leaders in the share registry business and technology transformation insights, C&R Group is ready to work with our clients and the industry to reap the transformational benefits of technology in share registry and corporate actions management. We already have a series of products and services that speak to this. Contact us and let us see how we can work together.

C&R Group 18th March, 2024

No comment