THE MISSING SHAREHOLDER: An analysis of the lack of shareholder representation in annual general meetings(AGM)

For listed companies, the Annual General Meeting (“AGM”) is a critical meeting. Apart from being a regulatory requirement for public listed companies, the AGM is the typical forum for companies to interact with their shareholders. Shareholders play a pivotal role in approving annual reports and even voting on crucial matters during the annual general meeting. For shareholders it is the forum for them to monitor and gauge the management of the company, to interact with the company’s board of directors and also to voice opinions and vote on company strategic and financial affairs.

Most companies therefore plan for their AGM with keen diligence, months in advance, with the hope for a smooth AGM with positive sentiments and contributions from shareholders and a smooth voting process/approvals on voting matters. However, it is important for companies to note that many shareholder sentiments and voting inclinations are developed ahead of the AGM. Therefore, waiting for an AGM to align shareholder sentiments with the company’s message is not the most effective approach. It is important for public listed companies to find ways to expand their engagement touch-points with shareholders, which will ensure that by the time of the AGM, their message has been transparent and consistent in reaching their shareholders.

It is also important for listed companies to consider the shareholder representation at AGMs. If the AGM is the main company forum to gauge shareholder sentiments, the company runs the risk of a limited global perspective if there are gaps in shareholder representation at AGMs.

At C&R Group we have done a study to analyze AGM attendance in order to identify whether there is a “missing shareholder”, or gap in shareholder representation at AGMs, and the potential investor relations for impact for listed companies.

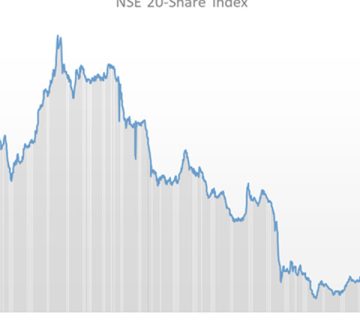

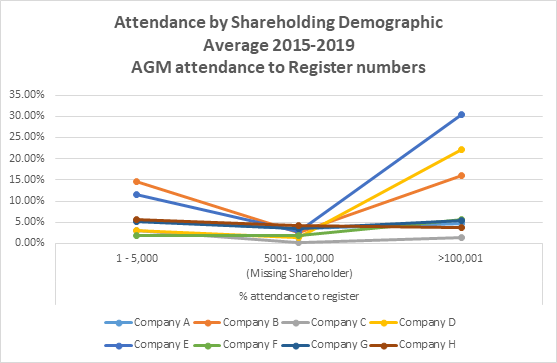

We analyzed data across 5 years, from 2015 -2019, for AGM attendance against the register shareholder profiles, using a sample of 8 companies. The data below shows the average performance over the years: It is noted that AGM attendance has gone up over the years, but with one consistent feature – shareholders whose shareholdings range from 5,001 to 100,000 shares, have the lowest turnout in AGMs. The main representation at AGMs are the strategic investors, either in person but generally through proxy, and nominees account holders, generally represented by one proxy from the nominee company.

The 8 sampled companies cover the spectrum of large companies (with over 10,000 shareholders) to medium companies, to smaller companies (with less than 5,000 shareholder). Why therefore is this middle tier of shareholders not attending AGMs and yet these shareholders, that are holding 5,000 to 100,000 shares, are typically active investors who are cashing dividends and engaging with news on the stock market. These are shareholders who have valuable opinions on company strategy and matters and yet are not presenting themselves in the main forum used by listed companies to engage with shareholders. These are the shareholders who can, and will block, corporate actions if they feel it is not aligned with their investing perspective.

Most shareholders in this category are busy professionals who, despite being active investors, do not have the time to attend AGMs. They therefore rely on broker, or individual, investment analysis as well as news and opinion pieces on listed companies. They are making investment decisions using 3rd-=party information, rather than direct information from AGMs. If there was a way to make AGM attendance more efficient, for busy professionals, the advantage of the better representation would be advantageous for both the listed company and the shareholder. The discussions and interactions between the listed company and the shareholders would be of better quality and better depth, creating opportunities for better message communications and alignment of company actions to shareholder sentiments, thereby minimizing potential for disruptive shareholder activism for critical, strategic initiatives.

For this reason, hybrid AGMs, i.e AGMs which allow for both physical and online AGM attendance, discussions and voting, is being favorably viewed by listed companies who are keen to achieve positive shareholder engagements as part of their investor relations strategy.

As C&R, we also share this sentiment, and have been actively developing our digital and online services for both shareholder services and engagements. C&R’s AGM system includes an online platform, with online registration, attendance, question submission, and voting features, that provides a complete, parallel online AGM forum that complements the physical AGM forum. It is noted that the cost of hosting a physical AGM is quite high for most companies, and yet for marginal additional spend, the AGM reach and effectiveness can be significantly improved by having a hybrid AGM. In 2019, two of our clients used our online AGM platform to hold hybrid AGMs https://candrgroup.co.ke/2019/06/07/cr-group-delivers-the-first-hybrid-agm-in-africa-through-sharehub/ with encouraging, early adopter results. We strongly believe that this is the future of AGMs and continue to engage our clients to explore this option.

Kerry-Ann Makatiani

CEO, C&R GROUP7 October 2019