SEVEN SECRETS TO SHARE TRADING IN KENYA

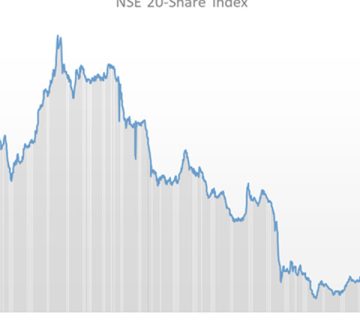

The Nairobi Securities Exchange has remained strong even as the bear market continues to dominate. Coupled with more companies issuing profit warnings, we have seen the NSE 20 share Index closed the month of October at 2,580.66 an 8% drop compared to last year’s October, 2018 2,810.32 performance.

When the market is on a downward trend it is time to take positions as both good and bad stocks prices drop in a bear market. Many strategic investors use a bear run to buy strong companies which will give good returns as well as buying shares in companies which give good dividends. If one bought high, then it may be a consideration to cut your losses and buy more alternative shares.

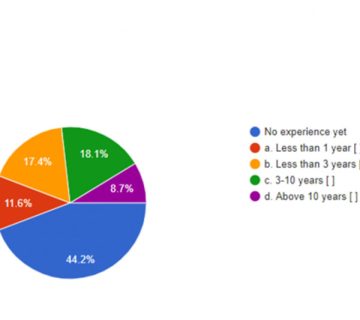

Experienced investors are well versed in the vagaries of the stock exchange and are not scared of navigating its choppy waters. This knowledge is essential to existing and future investors.

Following are some of the secrets experts recommend you should know when investing in shares:

Patience- As Warren Buffet once said, “The stock market is designed to transfer money from the active to the patient. Patience is a virtue when stock trading, before buying shares take time to analyse the companies, look for opportunities which will give you a discounted price and be patient as you await that price. Most important do not expect share prices to go up overnight thus be patient and you will enjoy the fruits.

Value- A company’s fundamentals will help you identify the companies with discounted prices, thus it is tantamount to establish the value of a company that you want to invest in. Do your research, get to know more about the companies before you invest in them. Their financial reports, dividend history and the price movements will give you valuable insights. Remember a share of stock represents a piece of ownership in a business.

Price– The price trend should be your friend while investing. Look at the company’s 52 week high and 52-week low, what is the yearly average trading price, the monthly average trading price. Armed with this information one can confidently make a decision as to whether to buy or not. It is always advisable to buy stocks at their lowest.

Liquidity– The higher the volume traded the higher the liquidity of the stock. It is advisable to analyse this when investing. A high volume traded with an increase or a decreased price will set the trading trend for that company and even for that industry and the whole market too. Be always on the look out of the highs and low traded volumes.

Think clearly- Do not let your emotions influence your judgement when trading. Know yourself and know your limits. Always remember the higher the risk the higher the returns. Do not rush to buy because others are buying, neither dash to sell because others are selling. Endeavour to be of high discipline in your trading decisions.

Research- we are constantly bombarded with stock market information from analysts. The views of analysts and regular traders is a great guide to buying shares. Take advantage of all the research that comes your way. Have regular, if not daily, updates on the performance of the NSE. Dedicate an hour a day and get information on the performance of companies you have invested in or on companies you want to invest in.

Philosophy- It is essential to have a formula to investment and try to follow it to the letter. Ensure to have a set of beliefs and principles that guide you in your investment decisions.

The bottom line is to always try to re-evaluate your portfolio and see where the stock is in relation to its book value. Trust in both the fundamental and technical analysis and be vigilant when making investment decisions.

Irene Mugua, Research Supervisor