Ethiopia open for business? What the recent political changes could mean.

It’s been 30 odd years since a great famine engulfed Ethiopia, a famine so gnawing, with pictures so vividly harrowing that it prompted world artistes led by the late great Michael Jackson to lead an aid campaign illustrated by the title of the hit single ‘We are The World’ which resonated globally. Having endured varying degrees of hardship and hope with one president after the other, the mantle now falls on

newly elected Prime Minister, Abiy Ahmed. With Ethiopia having been on the list of the fastest growing economies in the last decade, the question remains if the recent political changes, and the cautious opening up of the market, will herald even stronger growth or not.

With The IMF forecasting a 2018 growth of 8.5%, Ethiopia is likely to remain one of the fastest growing economies in Africa. Ethiopia has also surpassed Kenya as East Africa’s largest economy with an estimated GDP of $72 billion. So, what are key facets that need analysis in establishing future strength in a more privatized space?

Businesses are particularly excited by three sectors of note. Ethiopia still has one of the few telecommunication companies that are a state monopoly. Plans to privatize the sector are opening up the possibility of close to 70 million new subscribers which has regional and international players queuing up at the prime minister’s door to secure this potential mega deal. There are also cautious indications that Ethiopian Airlines is also on the privatization conveyor belt. Having posted a $232 million profit in 2017, this sector is also one that is very attractive to potential investors. The Energy Sector underpins all other efforts to grow Ethiopia economically. With a current approximate capacity of around 4,000 MW players are interested in setting up to increase this capacity in alignment with the government plan to increase this to 17,000 MW by 2020. Recent indicators of this are evident with Ethiopia cancelling their state run firm’s contract to install turbines for the $4 billion dam on the River Nile.

Water and The Nile is a key asset as a resource for Agriculture and Energy. However Ethiopia needs to tread carefully due to geopolitical interests downstream.

Airlines, Telcos and Energy are not the only industries seeing major milestones. Notable new entrants in the market include Dashen Brewery who are reported to have opened a beer plant in Ethiopia that has an annual capacity of 2 million hectoliters. Japan Tobacco International (JTI) has also now increased it’s shareholding in Ethiopia’s National Tobacco Enterprise Share Company to 70%. The rush for ancient Abyssinia cannot be likened to the 1848 California Gold Rush but the parallels are there.

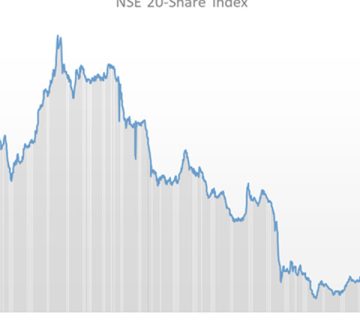

GDP and Annual Growth Rate

Ethiopia has been bullish in this regard with double digit or high single digit growth from 2008 and a good outlook for 2018. Fast growth coupled by government reforms to address export performance and weak trade balance is predicted to further enhance expansion especially in agribusiness and manufacturing. At the moment infrastructure needs shoring up, albeit this situation incrementally being remedied in the recent past, but is not a barrier to firms investing. German engineering and electronics manufacturer, Bosch Appliances plans to open a regional outlet in Ethiopia in 2018 further lending credence to the opening of the economy to global partners.

Conversely,Ethiopia is the largest country in the world without a stock exchange. The Ethiopian Commodity Exchange introduced in 2008 deals in maize, wheat, beans among other agricultural goods, however a diverse securities exchange would strengthen investor confidence even more. Public ownership of firms as they privatize could be a big boon if this changes and your average Joe would be energized by seeing the country’s world class growth visible in their personal portfolio. Economies like Kenya and Uganda have historically seen the value of owner’s equity in the form of shares driving expansion regionally. The outlook so far bodes cautious optimism.

With a 2018 population of approximately 107.53 million of which the youth are a majority, labour availability and critical skills will be critical in the coming decade. Photo by Trevor Cole on Unsplash

Unemployment Rate

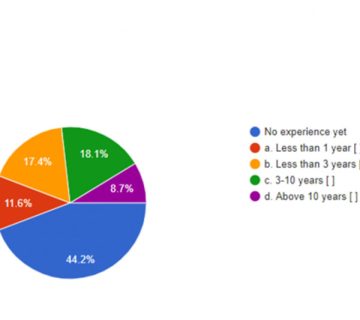

The twittersphere is inundated with hash tags advocating for safe spaces, education and jobs for youth. In addition to this, Ethiopia boasts a relatively young workforce. In an increasingly knowledge based and tech workspace, a population that can adapt to new technology quickly and work in an agile environment is a bonus. An economy with these facets working in its favour has a good outlook. A busy working nation is a good indicator of future growth and Ethiopia looks good in this regard. Unemployment rate has been steadily dropping from an all time high of 26.4% in 1999 (around the time when Generation Z children were born) to 16.8% in 2015 (when they are getting out of high school and most into the job market). This could imply that the chances of getting a job if you’re actively looking in Ethiopia are getting better.

Inflation (Consumer Price Index)

Consumer Price Index (CPI) as an indicator of the cost of living is generally accepted also as an indication of government fiscal policy effectiveness. Inflation affects the variation in prices paid by typical consumers for retail goods and other commodities. In other words what your average Joe pays for typical goods in their basket for home consumption. CPI is used as an economic indicator to measure inflation and can also be seen as a marker for how effective the government is in implementing sound economic policy. This has an impact on investor confidence and can give us a view into the oracle of prediction into the economic fate of Ethiopia.

With respect to Ethiopia, inflation has seen a slight reduction last month, registering a 0.7% drop from 14.7% in June 2018 to 14% in July this year. However, levels have been steadily increasing from 2012 to present. High inflation isn’t good news; it impacts the cost of living and the cost of borrowing as well as long term debt like mortgages. It is imperative that potential investors track the impact of this increase on the living standard and focus on social enterprise in order to forestall any negative impact.

The verdict

The Ethiopian market has paradoxical aspects. On one hand you have positive political winds of change blowing and increased engagement with the IMF on privatization and entry of global players. On the other hand a high inflation threatens the local population and a relatively low rank in the Ease of Doing Business Index. This uncertainty is actually a good environment for any entrepreneur with a good solid investment plan or a runaway idea to really succeed in this high risk, high return market. As the character Giriko Kutsuzawa states in one episode of the animated series ‘Devil May Cry’, “Time tells no lies.” Only time will tell the ultimate direction of this budding vibrant economy.

Denis Githinji, Customer Experience Manager, C&R Group

No comment