Could trading in shares be the next big thing?

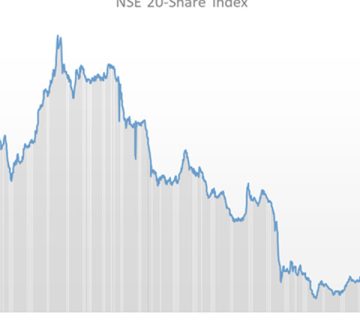

The Kenyan Stock market has come a long way since the first deals were made at the exclusive surroundings of The Stanley Hotel’s Exchange Bar in 1922, 97 years ago. Since the formation of the Nairobi Stock Exchange in 1954 coupled with the attainment of independence nine years later, trading in shares and the financial performance of listed companies have been regarded as a barometer for Kenya’s economic performance.

The Nairobi Securities Exchange (NSE) on Monday 14th October 2019 announced commissioning of a new equities trading system which is provided by LSED – Technology which is a member of the London Stock Exchange Group. The new system, it is believed will revolutionize the stock market as it allows short selling and day trading, and a few months ago the NSE started trading in derivatives, cutting edge technologies like this could drive our market to the next level and potentially bring leapfrog growth at the NSE.

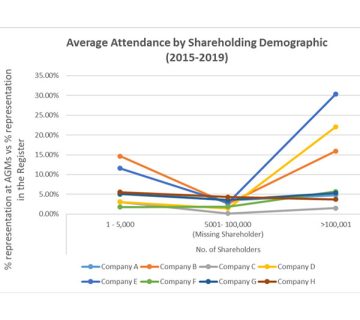

Despite the crucial role played by the stock exchange in business, the bourse is still viewed as an exclusive club for high fliers and individuals with plenty of disposable income. The Nairobi Securities Exchange, Capital Markets Authority, Stock brokerages firms, investment Banks and other players in the market are continuously trying to counter this perception through educating potential and existing shareholders. An increase in bourse activity through Initial Public offers (IPO’s) and digital technology has helped amplify the benefits of these investments with financial gains being the most popular.

Digital technology has made it convenient for traders to execute transactions from remote work stations as opposed to the previous practice of haggling on the physical trading floor of the securities exchange. It has also enabled online trading where investors are able to purchase and sell their shares in the comfort of their computers or mobile phones.

Another prime example is M-Akiba, a mobile issued retail bond by the Kenyan Government to finance infrastructural development projects which had a minimum investment of Kshs. 3,000 and was purchased through Mpesa. M-Akiba has given the retail investor the opportunity to enjoy the attractive interest rates offered by the government and previously exclusively enjoyed by institutional and sophisticated investors. It has also depended the capital markets and enhanced the savings culture of Kenyans.

It will be interesting to see how blockchain and artificial intelligence (AI) technology will contribute to the future of trading as interest surges. With 10 percent of global GDP expected to be stored in blockchain by 2027, if used in capital markets trading, it might make it more attractive to a new generation of investors who have a propensity for technology backed engagement. It could also potentially increase automation and decentralization of the trading process which would in turn help reduce costs on investors and speed up the transaction process.

Key Capital Market players including investors are always on the lookout for the next big thing in trading. The future growth in stock trading lies in the level to which participants choose to adopt enabling technology.

Irene Mugua, Research Supervisor