Does the UFAA have your money?

The essential list of how to know, how to recover your assets and preventing remittance in the first place

Do you have shareholdings in a listed company and have not claimed your dividends? Or have a bank account that you have not operated for a year or more. Possibly you could be a beneficiary of an insurance policy and were due for a payment more than two years ago but haven’t gotten round to collecting. In another instance, you could be an employee who has unpaid wages. If any of these scenarios are plausible in your instance you just might have some unclaimed assets kept in custody by the Unclaimed Financial Assets Authority.

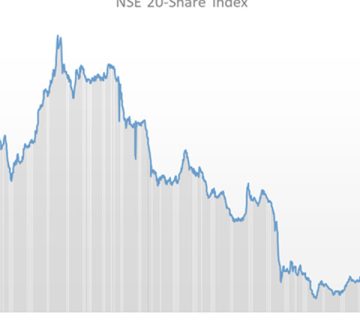

As at 2018, UFAA stated that it had custody of 8.7 billion shillings in cash, an estimated value of 16 billion shillings in shares. This roughly totals up to around 25 billion value on Kenyan’s behalf. You might feel that you don’t remember having any unclaimed assets personally, but a good percentage of this has to do with beneficiaries. This means you might be a beneficiary of some money you are unaware of relating to an insurance policy, a business or a relative.

What is the UFAA?

The Unclaimed Financial Assets Authority (UFAA) is an Authority created under the Unclaimed Financial Assets Act, No. 40 of 2011 to administer unclaimed financial assets. The primary mandate of the Authority is to receive unclaimed financial assets from the holders of such assets, safeguard and re-unite the assets with their rightful owners.

In extension to this, the UFAA has in its mandate the responsibility to receive, safeguard, invest and disburse unclaimed financial assets as well as to ensure that holders of unclaimed financial assets either re-unite them or surrender them to the Authority. They also periodically inspect unclaimed assets to ensure that what is held on your behalf is reflected accurately in the records. Moreover the UFAA makes efforts to locate and notify owners of the unclaimed financial assets as well as make payments out of the Fund to the rightful owners in accordance with the provisions of the Act.

This mandate further includes the right to manage and invest the funds of the Authority if not claimed by the asset holder within a certain period. The UFAA also acts as a trustee to the Fund in accordance with Part V of Unclaimed Financial Assets Act. This is by no means a conclusive list.

With all this value that you could potentially have a stake in, more and more people are seeking ways to establish what unclaimed assets are held on their behalf and how to recover them as well as how to prevent assets being remitted to the UFAA. The UFAA website has a link where persons can input identification information to confirm if the UFAA is retaining assets due to them. C&

How to know if you have unclaimed assets

There are a myriad of asset classes outlined in the act including cheques, dividends, money orders, savings, Insurance policies and annuities, court refund orders and even assets from dissolved business entities. The criteria and time period for determining dormancy varies across each asset class. Usually an asset is declared unclaimed and is required to be submitted by the holder if the following conditions are met.

The asset has not been claimed nor has the asset holder contacted the holder (company holding the asset) nor transacted with regards to the asset within the time period determining dormancy. This can happen for various reasons, including scenarios where the holder does not have updated details, such as postal details, bank details, for the asset holder and is therefore unable to pay or deliver the assets to the owner or other person entitled to the assets, therefore making the assets eligible to be classified as dormant assets.

In order to ascertain if you do have unclaimed assets you are required to fill in a form which can be obtained from The UFAA Website that explains the type of claim, whether you are claiming as the original owner of the asset, as a beneficiary, as a business or as an agent or representative. You then need to identify the holding institution and provide proof of identity be it your ID, Policy Number for Insurance or Account No. if it’s a bank.

How to Claim your Asset

Once you have ascertained that the authority indeed has your funds, there is a claim process outlined on the UFAA’s website which provides the forms and information needed to claim your assets.

What happens if I do not claim my assets?

The good news is that your asset is yours in perpetuity. This means that you cannot forfeit your asset. However, deductions can be made against your assets. This is within the law as the UFAA can deduct costs relating to the sale of abandoned assets as well as costs of correspondence and publication in relation to those assets. Other deductions relate to the process of inspecting records of holders and collecting assets from the holders. The UFAA can also sell abandoned assets after a defined period by public auction. This sale is preceded by a notice of at least 3 weeks in advance of sale in at least one national newspaper.

Tips to Keep your assets away from UFAA

Keep your records updated.

Whether it’s your bank or insurance company or stock broker or your registrar, it is important to keep you records updated. Key things you need to periodically keep an eye on to see are if there are any changes include your mobile phone number, your physical and mailing address (paying particular note to whether your postal code has been updated), your email address. Please list an email address you open at least weekly. In addition to this, transact periodically on accounts you own in order that they are not listed as dormant.

Show evidence of transaction

Holding companies expect customers to transact on accounts they own. This prevents dormancy. In order to keep your financial assets from being unclaimed it is important to check your bank statements regularly and promptly notify your bank/registrar or insurance provider if you have not received funds due to you. Another thing is you should keep your next of kin information, or a lawyer or a trusted person, updated on your asset holdings. Many assets remain unclaimed because beneficiaries of an estate do not have full information on all the assets that were held by the deceased shareholder. Therefore, instead of going to the benefit of loved one, these assets end up under the mandate of the UFAA

All in all the risks associated with losing unclaimed assets can be greatly reduced by i) keeping the details of your asset account updated and ii) keeping a trusted person- e.g. next of kin or your lawyer- updated on your asset holdings in the case of any unfortunate situation where you are unable to claim your assets .

Denis Githinji, Customer Experience Manager, C&R Group

No comment