Technology has today affected the way individuals communicate, learn and do business. Today, changes in the business environment couple with unprecedented technological changes have significantly influenced how corporate function is defined in most part of the world. Take the case of digital transformation. Digital transformation in many industries across Africa and the world has now become a part of a successful business strategy rather than just technology. It has led to opportunities of faster cost-effective operations, meeting regulatory deadlines, improved employee experience and remaining competitive. Technology has shifted how businesses interact with customers. Soromfe Uzomah who is Head of Strategic Partnerships at the Microsoft Africa Initiatives stated in one of his columns in The East African Standard Newspaper that “Digital transformation must be a keystone of the vision for a more integrated African economy”.

At C&R Group, technology, innovation and adoption have always been a critical core value for our strategy. We believe that technology creates the platform to innovate and provide us with an edge to meet ever evolving industry needs. For this reason, we have been the first in many technology innovations in the capital market industry. Let us take a look at some of our key systems that has transformed the way we conduct business in the market and has helped us make a difference to our clients:

C&R Digital Platform

C&R Digital is our proprietary digital platform that provides shareholders’ with access to online services including Virtual Annual General Meeting (“AGM”) services and market information.

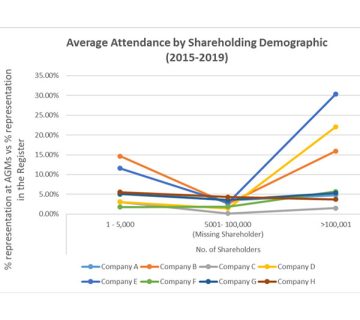

C&R’s Virtual AGM System is one of the products under the C&R Digital Platform. The Virtual AGM System enables a company to hold either fully virtual or hybrid, combined physical and virtual, access to a meeting. Shareholders/members are able to ask questions and vote on resolutions on the system. The Virtual AGM is either a videographed live event or a virtual meeting that is live streamed to shareholders/members accessing the Virtual AGM system on C&R Digital Platform. Shareholders can then access the Virtual AGM System from the comfort of their home/office through online access via computer, smartphone, tablet or USSD access via feature phone. In 2019 we conducted the 1st Hybrid AGM (both in person and virtual) for a Public Listed Company in Africa. Value added services

Amid major global disruption brought about by COVID-19, the way forward was for companies to either delay their AGM’s, and therefore delay critical shareholder interactions, or adopt digitization and hold Virtual AGM’s. At C&R Group our previous experience with holding a hybrid AGM and our significant investment in technology, gave us the platform to be able to execute fully virtual AGM’s. In the year 2020, we witnessed an increase in partnerships, with over 20 Companies opting for our virtual meeting services to meet their customer demands. List of clients

Mobile payment of dividends

Cheques, EFT and Swift have been used as means of payment for a long time, therefore people have built trust with these modes of payments. However, while EFTs and SWIFT dividend payment modes are bank to bank transfers and very efficient, payment by cheques has many gaps as an efficient payment mode.For example, for a shareholder to receive dividends by cheque, a cheque has to be sent to the respective shareholder’s postal address,. The entire process can take a week or more before the shareholder receives the cheque, let alone cashing it. Shareholders also tend not to update their postal address e.g. a shareholder was using a work post box and left the company and did not provide new details or a shareholder has not updated postal details on the register with appropriate postal code. As a result the shareholder’s cheque has a high probability of not reaching the shareholder. Adopting mobile money payment, C&R’s M-MgaoTM payment mode, provides an alternate option for shareholders who traditionally receive their dividends through cheques. Mobile money payment mode provides safety and convenience to shareholders, who can opt-in through a USSD shortcode *483*038# to register for mobile money payment. This payment method has proven to be safer, more convenient and have assisted our customers in accessing services seamlessly. Financial Services

Digital Bond/Right Issue

C&R Group has undertaken many projects during its existence including IPO’s, Rights Issues and Bond Issues. With these transactions, the length of time needed to complete the physical application process, the complexity of the transaction structure, and the presentation of physical documents required for the process to be completed can sometimes be quite involving.

C&R is always looking at technological disruptions to increase efficiencies in our capital markets. In two recent Rights and Bonds Issues, C&R introduced a technology platform for online applications processing to address a key challenge for these issues, which is receiving the applications in a timely basis to allow for processing. In the online application technology platform the investor first creates a unique account on the platform, and then uses that account to apply for and confirm payment for the corporate issue. The platform can be accessed individually by investor log-ins on the portal, or through the branch network of an institution. This has reduced the time taken by investors to submit applications and provides visibility to both the broker and the data processor about submitted applications. As a Bond Paying Agent and Share Register, this technology has been instrumental to investors who were able to seamlessly and successfully transact without necessarily having to physically present required application documents. We managed and processed Centum Re digital Bond and also managed and processed Credit Bank’s Right Issue using the online application process. Project undertaken

Electronic document management

C&R uses a CRM system with fully integrated scanning processes. We have also had to create a digital inventory (scanning and indexing) of historical documents used for shareholder verification. We have expanded this experience gained internally to a commercial service. C&R’s document management division offers services around the conversion of physical records to electronic digital repository, therefore creating efficiency in cost of space and access to information. Value added services

These three technological transformations have disrupted the market with improved efficiencies and helped our clients achieve phenomenal results and overcome challenges brought about by an ever changing business environment.

Kwach Oluoko

Manager, Business Development