Well, maybe not by the strict definition of Big Data as “data sets that are so voluminous and complex that traditional data processing application software are inadequate to deal with them” (source: Wikipedia) but definitely data capture, analytics, storage are becoming critical to the emerging requirements on share registry.

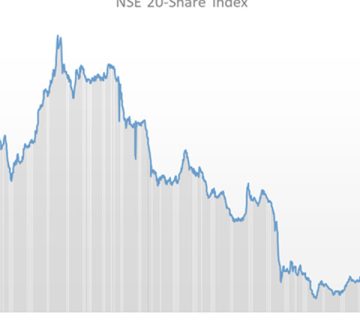

With increasing need across Corporate Kenya for better data analytics on share register data to meet emerging trends in investor relations and market transparency, regulatory scrutiny and compliance needs as well as shareholder demands for better and improved communications and access to corporate data, share registry is increasingly becoming technology driven to meet these requirements.

Trends in share registry show that shares registrars are increasingly being viewed as an outsourced Investor Relations function for their clients.Photo by rawpixel on Unsplash

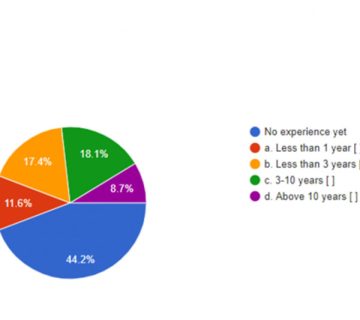

Custody & Registrars Services Ltd, as one of the largest Share Registrars in East Africa, with over 30 years’ industry experience has first-hand experience of the emergence of technology and data analytics in share registry. As a shares registrar we are dealing with hundreds of thousands of shareholders on behalf of corporate clients. We are responsible for keeping data going back decades to be able to answer shareholder queries. We need to store, pull and analyse data from multiple sources to meet new regulatory requirements. We may not be “big-data” in the traditional sense of the definition, but coming from a historical single or dual system industry to where we, as C&R, now have a Customer Relationship Management ticketing system for tracking, processing and managing shareholder requests from a single repository, a Queue Management System for walk-in shareholders management, a Storage Access Network System for real-time data back-ups, Share HubTM System for online data access and AGM management, an Integrated Dividend Payment System for real-time clearing data as well as our core Share Registry System for secure shareholder data storage and access, we feel like we are going big-data managing all these systems and their data, but it is the only way we can meet emerging industry requirements. It is now a factor of share registry that will only become more prevalent.

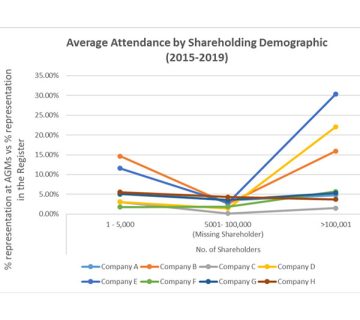

Trends in share registry show that shares registrars are increasingly being viewed as an outsourced Investor Relations function for their clients, or at minimum auxiliary support to an internal Investor Relations function. Companies are dealing with more complex requirements from active shareholders and increased regulatory oversight and share registrars are expected to have the data to be able to meet these requirements. Global trends in Investor Relations show expanding or enhancing engagement with shareholders was the highest IR focus in 2017 (source: BNY Mellon 2017 Global Trends in Investor Relations). Share registrars therefore need to be able to help their clients meet these emerging needs. “At Custody & Registrars, we have structured our business into our core share registry business and our value-added services, such as our Call Center services and our ShareHubTM application, that are aimed to assist with shareholder engagement as well as with bringing relevant data closer to the shareholder. We also noticed that engaging a wider diaspora of shareholders is an increasing trend, particularly as our markets become more attractive to foreign investors. Our ShareHubTM system has as online AGM attendance application that allows shareholders to register for, and attend, an online AGM broadcast. Technology enablement will only become a more integral aspect of share registry services”

The research into global investor relations trends also indicates some areas that will have the greatest influence on the function of Investor Relations in the next 10 years (source: BNY Mellon 2017 Global Trends in Investor Relations). Some of these factors include changing shareholder structure, from passive investments to more active investments. In some instances, shareholders have gone beyond active to activist shareholders, blocking intended activities by the board and management of corporate companies. Engaging these shareholders will be critical to managing their interests alongside corporate company interest. Other global trends from the research that are immediately relevant in the Kenyan and wider East African markets are Market Transparency and New Regulatory Requirements. Over the past few years, Kenya has seen at least two new regulatory acts with significant impact on data requirements and reporting, namely the Unclaimed Financial Assets Act and the Companies Act 2015. In addition, new financial reporting requirements will result in changes in accounting treatment and disclosures.

With the introduction of new Regulatory Acts impacting our industry, we have found it necessary to establish relationships with the regulators by taking up a liaison role between the regulators and our clients to better understand the requirements and advise clients on this. This as well ensures that we can pull the data and reconcile the data from our various systems to meet the reporting requirements. As C&R Group we are happy to play this role as we see ourselves as more than a share registrar, but a custodian of wider investor relations.

Kerry-Ann Makatiani, CEO C&R Group

No comment