Kenya has just introduced new look currency notes and the current KES. 1,000 note will cease to be legal tender by October 1st 2019. The introduction of the new currency is in line with the new Kenyan constitution that was promulgated in 2010 while the process of mopping up the country’s biggest denomination is aimed at countering rampant money laundering and illicit cash flows.

Central Bank of Kenya has also put in place increased tight controls on the high value bank deposits and cash exchanges to further check the illicit cash flows and also drive more transactions to be carried out electronically.

We are not the first, India carried out a surprise demonetization exercise in 2016 with the same goal of flushing out their system of cash that was obtained illegally and carried out this process within weeks with mixed results. The Indian economy lost 1.5% of GDP, over 100 lives were lost, hundreds of thousands of jobs lost, thousands of SMEs closed and in the end about 99.3% of the money that was out of circulation was returned. However, digital transactions grew though the notes in circulation also still grew.

Questions abound over how the same policy will affect the average Kenyan. Here is what you need to know:

- The new banknotes will circulate along those previously issued, other than the old KES.1000 note. This move seeks to avoid massive shocks to the economy that is cash based as was the case in India.

- The older KES. 1000 will cease to become legal tender on October 1st This move is expected to lead to less counterfeits and more faith in our currency markets

- Expect to see more liquidity in the economy as cash hoarders might introduce their money into the formal financial system

- Digital transactions are likely to increase as Kenyans who usually deal in physical cash may find this channel more convenient that moving around with bulky notes or coins

- Increased digital transactions could lead to heightened cyber crime

- Sectors like real estate and high value luxury items are likely to see an influx of investments as money launderers try to ‘clean’ their ill-gotten wealth through the establishment of physical assets. This move might further weaken the housing market and increase the prices of high value luxury items such as luxury cars.

The outlook for achievement of the objectives set out by the Central Bank of Kenya is very positive and Kenya is likely to see more positive benefits than others that have tried the same before. This is because it is being done in a more structured manner with a wider time window, and has been preceded with an active transition over several years of policies aimed at driving towards electronic payments and an upsurge in the prevalence of mobile transactions at the retail level which is usually dominated by cash transactions.

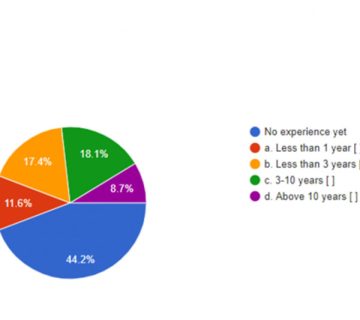

No comment