UNDERSTANDING SHARE BUYBACK

A share buyback also known as share repurchase usually involves the company’s management buying back part of the shares they had previously sold to the public. The company by buying back the shares eliminates them from the market thus ensuring there are fewer shares of the company in circulation. The company records the buyback shares as treasury stock (shares with no voting power kept by the company and not available to the public)in their financial statements.Popularity of share buybacks in the developed markets is evident, as far back as 1999 over 1,200 companies listed on the New York Stock Exchange repurchased their own shares that year. Here in Kenya the Companies Act, 2015 introduced the concept of share buybacks and it is well detailed in section 447 part XVI.Nation Media Group the largest Media House in East Africa is the first company in the Kenyan Bourse to issue a buyback.

A stock repurchase is a win-win situation for both companies and shareholders, as during a share buyback the company reduces the stock supply thus preventing its value from declining. For example, if company X has 1000 issued and paid up shares and a shareholder has 100 shares, his or her stake in Company Xis 10 percent (i.e.100/1000 = 10%). If the company through a share buyback buys 100 shares and redeems/eliminates them, 900 shares will remain in circulation. The shareholder’s participation will become 11 percent of the company (i.e.100/900 = 11%). An increase of 1%.

Managing the shares value further leads to an improvement in the company’s Earnings per Share (EPS) which is a good indication of the company’s profitability and this in the long run boosts its share price. Companies’ management use share buyback to express their confidence in their company and send out a clear message that the stock is undervalued.To incentivize shareholders the Company will offer a strong price for its shares therefore presenting an attractive offer for those shareholders who are interested in taking up gains on the share price as opposed to a long term hold.

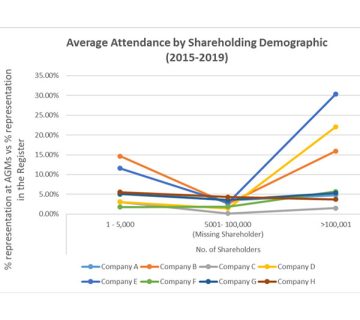

The NSE 20 share index, which is one of the longest standing benchmark index used at the Nairobi Securities Exchange show the Kenyan Stock market, has been on a decline for the last five years as shown on the graph below. The NSE 20 share index has shed over 50% from4,007.33 points on 4th January, 2016 to the current figures of 1,975.02points as at 10th August 2021.The market hit its lowest of1,723.96 points on 21st August, 2020during the period of the second wave of Covid-19 pandemic in the country.

The graph below shows a five year NSE 20 share Index trend from 2016 to the current figures. The NSE 20 share index is calculated on a daily basis on 20 blue chip companies against; the company’s market capitalization, volume of shares traded, liquidity levels and the turnover. Thus this trend shows even blue chip companies lost their share prices as the market went down, leading to most of them being undervalued.

Source: NSE

On 31st May 2021, Nation Media Group (NMG) issued a share buyback circular to shareholders, proposing a buyback of up to 10% of its issued and paid-up share capital (20.7 million shares). Currently the issued and paid up shares are 207.4 million shares and the buyback will reduce issued and paid up shares to 186.7 Million shares. The company started buying back the shares on 28th June, 2021 where NMG investors have a grand chance of cashing in on their investments at a price of Kes. 25 per share. Before the announcement of the buyback the price of NMG was trading at Kes.17.25 as at 28th April, 2021, the buyback shares of Kes. 25 was therefore a 45% increase on the share price. The company has traded over 16 million shares at an average price of Kes 25 since the opening of the cashback on 28th June, 2021. The buyback will close at the attainment of the 10% buyback or on Friday, 24thSeptember, 2021.

Source: NSE

Studies show that one of the main drivers of share buybacks is positive sentiment on a company’s financial performance. Tech heavyweight Apple recently approved a share buyback repurchase of an additional $90 billion and other international companies are also seeking buybacks as they are optimistic about their near-term prospects as the economy at large continues to open up amid rapid vaccinations. The stock market has undergone volatility and inflation remains a major worry but companies like Nation Media Group Plc are seeking to change the ball game and be proactive about managing their shares value.This type of proactive management can only have a positive effect on the market.

Irene Mugua

Senior, Business Development Supervisor