Investor Relations (IR) continues to be a fundamental pivot point for companies and engagement with all shareholders needs to be continuous. The capital markets growth is highly attributed to investor sentiments and deepening investor relations plays a major role in market improvements. Company secretarial roles which previously were deemed administrative no longer are but must work hand in hand with the investor relations teams to steer forward these shareholder engagements. The retail shareholders have evolved from passive to active and in some cases even to activism. It is therefore essential to effectively manage and communicate to your retail investors as a company.

After the successful launch of our new division CSuite IR- Investor Relations Services in 2018, C&R Group continues to support the market with further regular round-table engagements and held a breakfast meeting with company secretaries and investor relations personnel from listed and non-listed companies to have an engaging discussion on Investor Relations, the theme for the breakfast was, “Secrets to Becoming a Hero in Retail Investor Relations”

The breakfast was started off with a brief introduction from our CEO Mrs. Kerry Anne Makatiani who emphasized that we as a share registrar we are the face of the companies and engage with retail shareholders on a daily basis and the feedback we are getting from them is that, ‘they need to have more communication and engagements with the companies”. From further engagement meetings we have held with retail investors the sentiments are the same, we need more from the companies we have invested in. The presenters for the day were Paul Kihiu, Business Development Director, C&R Group and the Legal and Governance Manager C&R Group.

Using an online poll the attendees were requested to list their expectations for the event, which included Online AGMs, Investor Relationship management, Trends in shareholder activism, How to improve engagement with retail investors, Ways of undertaking successful surveys and determining the impact of Integrated Reporting on investors, Determining what matters to investors, i.e. the shift from data to quality, Managing the conflict between corporate strategy and transparency, Issue of Gifts during AGM, Future outlook of the industry and generally how to manage shareholders effectively. Paul commended the attendees on listing their expectations and welcomed them to enjoy the presentations which would cover many of their expectations and others too.

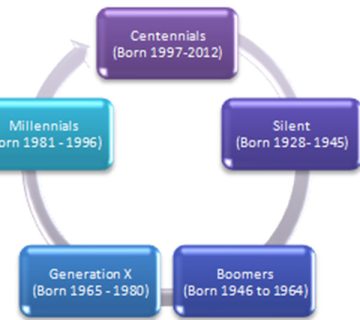

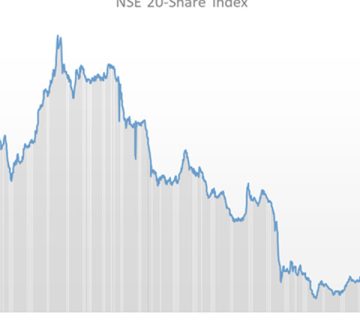

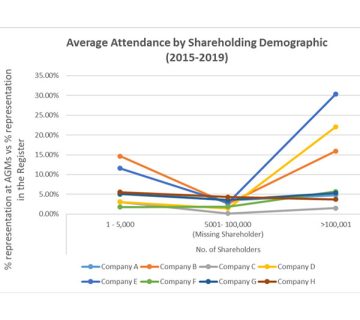

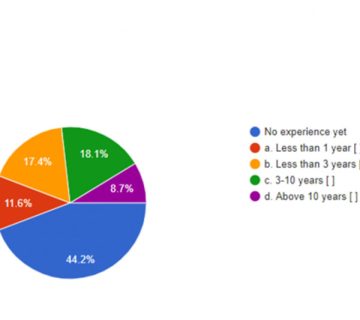

The attendees were led by Paul in analyzing the performance of the capital market in recent past, he showed the graphical presentation of the 20 share index from 2009 to 2018. He also showed various data from CMA indicating that there were 1,232,702 total investor accounts as at end of 2018. The local individual investors were 1,175,852. Local investors accounted for 80.03% of shares held in the equity market with 19.97% being held by foreign investors. Around 66% of the investors are male while as 34% are women. Based on our interactions with shareholders the young generation continue shying away from the market with only a small percentage of young people under 35 investing in the stock market. The different types of retail investors were also included in the presentation.

The attendees were taken through some insights on the rise of the retail shareholder and the manner in which some of them are driving their activism to successfully resist various corporate actions that they deem unfair to the minority shareholder. They were also informed that retail investors trust the information they receive from peers and media with the younger generation especially sourcing this information via social media platforms.

The attendees were also guided through a discussion on why as issuers they should be concerned with the prices of their stocks in the market and some of the actions and approaches they can consider to positively impact these prices.

The findings from C&R Group’s various engagements with retail shareholders on their expectations from listed companies in which they invest and why they invest in them was extensively shared and deliberated to enlighten on how best to then meet these expectations and delight shareholders.

We presented to the attendees a survey done by Capital Markets Authority, Report on the State of Corporate Governance for Issuers of Securities to the Public in Kenya 2018. The report was published by the CMA in 2018 and circulated in February 2019. 2017/2018 findings: 55.00% weighted overall score is/was a good starting point as a first assessment to issuers on their application of Corporate Governance practices as espoused in the Code. In comparison, the ASEAN assessment indicates Indonesia at 43.29% and Thailand at 67.66%. The specific principles that were addressed were, issuer performance on the rights of shareholders and overall sectoral performance in stakeholder relations.

The discussion on the 21st Century AGM on the virtual and the hybrid AGM’s generated a lot of interest with thoughts shared which included, Hybrid AGM’s will give a chance to the young generation who do not attend physical meeting to participate in the AGM’s, it is good to ensure to mirror the physical AGM’s while tackling the virtual AGM’s too, the approach should be the same and ensure all due processes are followed thus the approach taken should be supported by the law and ensure that companies’ memorandum and articles of association conforms to this too. It was indicated that the quality of questions asked during AGM’s are often poor and online meetings may give better quality of the questions asked by broadening the audience.

The retail investor issuer relationship is expected to be two-way, the retail investor is rising and they are ready and expect to deepen the engagements with the issuers. The online AGM’s will give the chance for the company to track the questions and be prepared for the next meeting, and the interaction can continue online even after the formal AGM has ended.

The big question remained…. “Is our market ready for the 21st century AGMs?”

Many more questions were debated, these include; The 21st century AGMs require investor education, and the question arises on who is responsible for this? Which role will the Capital Markets Authority (CMA) play on this? AGMs are not regulated by CMA; the company is in control, so how does the regulator support or play their role in this?

It is good to acknowledge the cost benefits of hybrid or virtual AGMs might not be realized in the first year, the fruits will start being realized later on as the new methods take a foothold.

The last presentation was on the Unclaimed Financial Assets Authority (UFAA), the attendees were taken through some of the highlights on why a company must proactively manage its unclaimed shareholder assets and how C&R Group can support this process to ensure that the company fully complies to the UFAA requirements and ensures that the owners of the assets are adequately sought and engaged to ensure they are reunified where possible before these assets are submitted to the UFAA. It was also explained how this impacts on shareholder sentiments.

In summary, it has agreed that it is becoming increasingly clear that Investors and other stakeholders are now also interested in information that goes far beyond what is available in the standard annual reports or financial reports results leading to a lot more focus on non-financial and operational information. The rights of the minority shareholders specifically the retail investors have also gained prominence. It is clear there is a demand for companies to deepen relations with investors. C&R Group through our Investor Relations (IR) division, will continue engaging with shareholders and our partner listed companies to deepen this relationship and enable a more positive and deeper investor relationship and by extension better investor sentiment. We are ready to walk this journey with companies across East Africa as we strive to become heroes in Investor Relations (IR) together.

Irene Mugua – Research Supervisor

No comment