CAPITAL MARKET VOLATILITY IN AN UNEXPECTED PANDEMIC

2020 has been the year riddled with an unexpected pandemic that is Covid-19. Whereas past empirical research has shown that stock markets readjusts for normal market macroeconomic forces, a pandemic like this one, which shocked the whole world, has led to a baffled capital markets environment.

Prior to the pandemic of 2020, Kenya was ranked at position 61 in the ease of doing business category, out of 190 participating economies, according to the World Bank Group’s Doing Business Report, 2019. The 2019 assessment was a steady improvement from 92 in 2017 and 80 in 2018 and a clear indicator of a better business environment by the Government. This was also evidenced by the high foreign activity at the Nairobi Securities Exchange (NSE).

Data Source: WHO

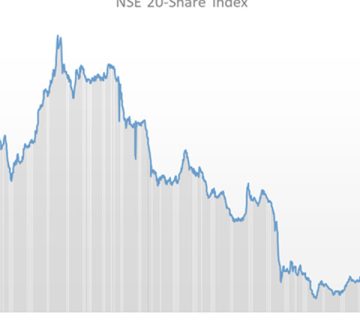

The NSE 20 share index which is one of the longest standing benchmark index used at the Nairobi Securities Exchange is calculated as a mean of the top 20 best performing counters. This is calculated on a daily basis on the 20 companies’; market capitalization, volume of shares traded, liquidity levels and the turnover.

The Kenyan Government publicly announced the country’s first Covid-19 case on 13th March 2020, the same day the NSE 20 share index was at 2124.78.

Data Source: WHO figures, NSE

As indicated by the graph above, the NSE 20 share index decreased by 17% from the day the first case was reported to its current position of 1756.90 as the Covid-19 cases continued to rise.

We have seen similar slumps in the past due to different factors. The Oil crisis of the 70s saw the NSE halt in 1972 due to depressed share prices. The introduction of 35% capital gains tax in 1975 also saw a slump in the NSE. In addition to that, the volatile environment after the 2008 elections caused the stock market to decline.

With this context in mind, it begs the question: What informs investors’ decision to buy or sell their shares particularly in situations of major market factions? Behavioral finance holds the view that in practice, markets are far from perfect and investors are not rational. Investors often let emotions overrule rational analysis. This is a major reason for the huge volumes sold during volatile periods, such as a pandemic, election years and recessions, occasioned by low confidence in the economy. While some investors do panic selling, other investors take the opportunity to buy for long term hold.

The 2021 forecast on the market is majorly influenced by the containment of the Covid-19 virus, along with the discovery of a vaccine. However, we are seeing recovery of stocks in certain industries such as banking. Despite any recoveries, we can expect companies to continue to focus on stability over profitability during this period. This therefore means that, as witnessed in 2020, companies may not issue dividends to shareholders. This may lead investors to do panic selling or quick selling to recover money, due to income loss occasioned by the effects of the pandemic. Therefore, for savvy investors, it is the right time to assess stock fundamentals and buy stocks.

The stock market is not for the faint hearted, knowing the survival tricks is key read our article to gain more tips on trading. http://candrgroup.co.ke/publication/seven-secrets-to-share-trading-in-kenya/

Lilian Muringo,

Business Development