Ten Important Terms You Should Know Before Trading In Shares

Trading in the stock market is not for the faint hearted, it can be a daunting task for anyone who is not well versed in its intricacies and terminologies.

Most shareholders usually rely on brokerages or other third parties to trade on their behalf but its important to learn the basics of how stock markets operate.

Below are some of terms potential shareholders need to understand before they make that important financial decision to trade:

Stock Exchange- this is a market that allows people to buy and sell stocks of listed companies. The Nairobi Securities Exchange (NSE) is the Kenyan Stock market. In Tanzania we have the Dar es Salaam Exchange (DSE) and the Uganda Stock Exchange(USE) in Uganda. In the US we have New York Stock Exchange and NASDAQ.

Annual Report- this is issued to shareholders at the conclusion of every financial year. It contains information regarding the company, balance sheet, profit and loss accounts, cash flow, management strategy, executive appointments and CSR activities. This report helps investors judge a company’s financial position.

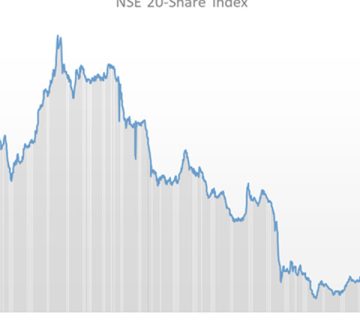

Bear Market- a bear market refers to a period of falling stock prices. If there is a general plummeting of company prices in a stock market this is signified as a bear market.

Bull Market- This is a prolonged period of increased stock prices in a stock market.

Blue Chip- These are large companies which are industry leaders offering stable dividend payments. Blue Chips at the NSE include, East African Breweries, Safaricom, Kenya Commercial Bank, Barclays Bank of Kenya and British American Tobacco. These companies usually have significant dividend payments and have a reputation of sound fiscal management.

Stock Broker- an individual who buys and sells shares on a shareholder’s behalf for a commission. They are authorized participants to trade in the NSE by the Capital Markets Authority.

Bid- an amount of money a trader is willing to pay per share for a particular stock

Dividend- a portion of a company’s earnings that is paid either quarterly or annually to shareholders or people that own a company’s stock.

Index- a benchmark that is used as a reference marker for traders and portfolio managers e.g. NSE 20 share Index, and the NSE All share index(NASI)

IPO- This is Initial Public offer, the first sale or offering of a stock by a company to the public. A private company becomes a public listed company which shares are available to investors to buy at the stock market. Some of the most successful IPOs in recent memory at the NSE are Safaricom, KenGen, Kenya Re and Access Kenya.

Irene Mugua, Research Supervisor