estate viz a viz Intestate / Will Viz a viz No Will

Introduction

Almost all Kenyans are not willing or postpone writing a Will. Maybe it’s because we don’t want such a tangible reminder of our mortality. Among the various cultures in Kenya, death is never discussed. It is viewed as a way of provoking it. In some cases, even with the elite society, it is viewed as the process of relinquishing the ownership of our property. Below is a snapshot of a survey conducted by C&R Group on succession and its various facets with a focus on Kenyans and Africans of Asian origin.

Who we are

- C&R has been providing share registry services since 1986. Over the 30 year period C&R has grown to be the largest registrar in the country with a market share of 33 per cent among listed companies.

- It has diversified its product basket beyond maintenance of shareholder registry to include document management, business process outsourcing and company secretarial services.

- C&R has also expanded its geographical reach to open operations in Uganda.

- The main role of C&R group share registrar’s services is the transfer of shares from certificated form to CDS account.

- Transfer also known as transmission process, is the transfer of shares from one party to another.

- The transfer is facilitated by the Nairobi Securities Exchange’s licensed stockbroker. Transfers are in two categories as follows:

- Transfer documents due to death of a shareholder or death of one shareholder for joint accounts.

- Transfer of shares due to gift.

- Recently we have installed a new more robust Kayako system allowing us space for enhanced data analysis.

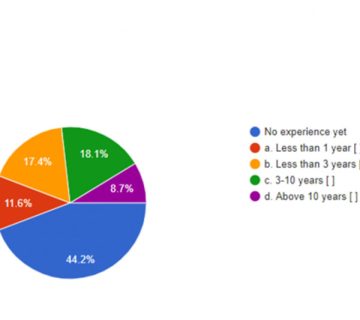

- We collected data from the transmission documents we received and analyzed the shareholder who died in Testate Viz via Intestate.

Below is an analysis of the succession Planning

Succession Planning

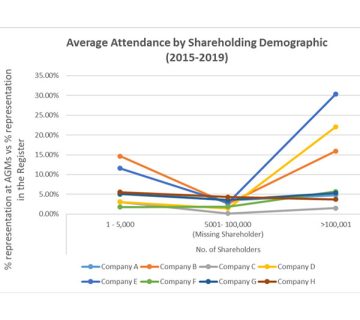

- Testate – Where there is a will = 59 cases

- Intestate – No will = 613 cases

- If none of the beneficiaries is aware of existence of the shares and no claim is filed then they become unclaimed financial assets.

- Dividends not claimed for a period exceeding five years are transferred to UFAA

What is the profile of investors who wrote wills?

| Intestate Breakdown to country of origin | |

| Arab | 2 |

| CANADIAN | 1 |

| INDIAN | 40 |

| KENYAN | 9 |

| UNITED KINGDOM | 7 |

| TOTAL | 59 |

- Members of the Asian community are the most consistent in passing on their wealth to the next generation.

- Lack of writing wills among Kenyans has been attributed to fear of discussing death.

- There were 601 transmission cases involving Kenyans

- Only One per cent had a will.

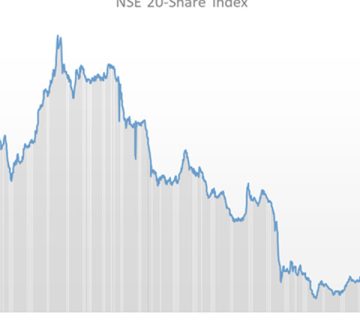

- Most of those who inherit shares in absence of a will tend to sell soon after transfer.

- Price is usually not a consideration

- Indication of little connection between the deceased investment strategy and that of the dependents.

- Investors in securities exchange are taken to be among the elite in the society who would know the need of a will – indicating the scenario is worse for other investment options.

Conclusion

- A Will allows you to select the individuals who will receive what you own when you die.

- A will also prevents your assets getting forwarded to the Unclaimed Financial Assets Authority

- A Will includes specific directions on how you wish your estate to be distributed after your death, including provisions for any tangible personal property that you may own.

- If you don’t have a Will in place, you can’t select the recipients of your property and the Kenya Law of Succession Act will determine how your property is divided.

Whatever the excuse may be for putting off the drafting of a Will, many people do not realize that writing one actually prevents what is feared. In fact, a Will may be the most important document that you ever write, because it allows you to select the persons who will own or receive what you have worked for so many years and value the most when you die.

Will you draft your Will today?

No comment