ARM CEMENT: HOW THE INSOLVENCY ACT PROTECTS THE SHAREHOLDER

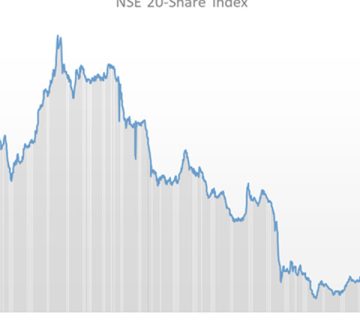

Recently, news broke regarding a long-time player at the Nairobi Securities Exchange (NSE). It was reported that Athi River Mining Cement (ARM) had been placed under administration with Pricewaterhouse Coopers (PwC) given the mandate to be administrators. In a public announcement made on 20th August 2018, the bourse announced that trading of the ARM shares had been suspended for a period of 7 days. Social media was awash with commentary on what this meant for the cement industry and the state of the Kenyan capital market.

What was however understated is the crucial role that the Insolvency Act played in ensuring that instead of ARM Cement getting liquidated, it was placed under administration to give it a fighting chance. Enacted in 2015, this crucial piece of legislation allows companies to get their act together during times of financial turmoil. Previously, companies would be liquidated. Now they can continue operating while under administration. In regard to section 558 (1), when a company is put under administration and during the administration:

a) An application for the liquidation of the company may not be made

b) Any application for the liquidation of the company that is then pending is suspended

According to section 520 of the Insolvency Act, an Administrator is defined as, “A person appointed under this Part to manage the company’s affairs and property, and, if the context requires, includes a former administrator”

The Objectives of The Administration of a Company are as follows pursuant to the section 522 (1):

a) To maintain the company as a going concern

b) To achieve a better outcome for the company’s creditors as a whole than would likely be the case if the company were liquidated (without first being under administration)

c) To realize the property of the company in order to make a distribution to one or more secured or preferential creditors

A company going into administration is not an ideal situation. It is however a better position than the one the company would have been in before the Insolvency Act of 2015 was passed. The Act is meant to protect stakeholders of a company from losses that would be caused by the collapse of a company. The shareholder is especially protected by The Act as it ensures that once a company is put under administration, shares cannot be traded. This prevents the share price from declining further as a result of investors’ reduced confidence in the potential of the company.

Being put under administration can be good for the share price in the grand scheme of things. This is because the new lease of life given to companies inspires confidence in stakeholders. As markets closed on 17th August 2018, a day before ARM Cement was put under administration, the company saw its share price increase to be the largest gainer of the day at the bourse.

For now, all eyes will be on what the administrators of ARM Cement are able to do to turn things around at the firm. If Uchumi was able to turn things around during administration, ARM can too. Whatever happens though from here, the Insolvency Act has shown us that investors and potential investors can afford to have confidence in Kenya’s capital market as there are systems put in place to protect their investments.

No comment