Financial security is the primary reason for investors to purchase shares in listed companies.

According to a survey carried out by Custody & Registrars (C&R Group), 66 percent of respondents’ regard investing in the stock market as key to attaining financial freedom, securing long term profits, guaranteed returns and developing additional income generating projects.

Most respondents consider between 10 and 20 percent as a good rate of return on their investments.

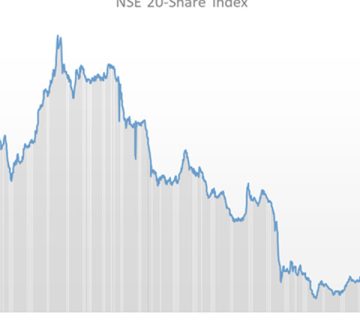

Despite 82 percent of respondents expressing interest in stock trading, some of the reasons holding back potential shareholders include lack of knowledge, an unpredictable market and poor returns.

According to a Capital Markets Authority (

CMA) study published in 2018, the main reasons why there is limited participation in stock trading include low liquidity levels, regulatory obstacles, macroeconomic factors, competition from other sectors e.g. infrastructure bonds and lack of a coordinated market strategy

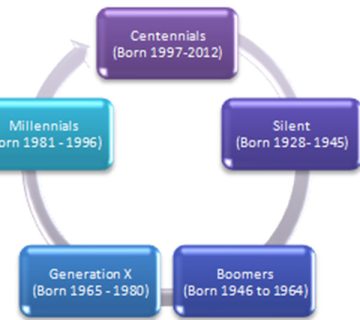

Another point of concern is that Kenya’s most productive demographic as a group i.e. 26-40 age group are not actively involved in stock trading. The challenge is upon stakeholders in the finance industry to demystify market participation in order to get this segment involved.

This can be done through employing the use of mobile technology in stock trading, developing new segments at the bourse and educating potential shareholders on the stock trading process.

Listed companies, brokerages, share registrars and financial advisors can edu

cate current and potential shareholders through regular interactions especially in the digital space if they are keen on securing young and first time investors.

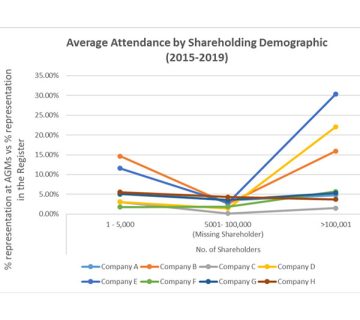

The survey also reveals that 73 percent of respondents bought their shares directly, 28 percent don’t have any bourse investments while two percent inherited their portfolios.

Brokerages, online investor forums, market rumours, media and referrals are some of the avenues that help the public make investment decisions.

Majority of respondents are keen on receiving timely information on how their stocks are performing.

Most investors rely on market authorities like the Nairobi Securities Exchange (NSE) to analyse the markets.

46 percent of respondents stated that they had already made profits on their current portfolios, an indicator of the strong performance of some NSE counters.

The survey also illustrated the future of stock trading with 78 percent of respondents willing to secure earnings in a virtual stock market. This trend is set to dramatically alter the share trading landscape.

Denis Githinji-Customer Experience Manager