Why Uganda is ripe for IPOs

Uganda broke its six-year IPO drought, since the listing of Umeme in 2012 when Kampala based drug maker, CIPLA-Quality Chemicals Industries Limited (CIPLA-QCIL), listed on the Uganda Securities Exchange in 2018 with Renaissance Capital as the Lead Transaction Advisor, Crested Capital as the Lead Sponsoring Stock Broker and C&R Group as the Share Registrars.

What is an IPO?

An Initial Public Offer is when a corporation or private company offers its stock to the public for the first time on a stock market such as the Ugandan Stock Exchange (USE) or the Nairobi Securities Exchange (NSE).

Why do companies carry out IPOs?

1. To raise money for expansion/growth, to make an acquisition or to have some money in the bank for general corporate purposes

2. The existing private shareholders want to exit and sell their shares to other shareholders

3. A combination of both 1 and 2

CIPLA ICQ Bell Ringing event at Serena Kampala in 2018

What are the benefits of an IPO to a company?

- Raising of funds for expansion and growth without the burden of borrowing from lending institutions

- Increased public awareness about the institution and its products

- Realization of the valuation of their enterprise

- Improvement of the liquidity of securities

- Lengthened components of the capital structure, especially debt

- Optimization of capital structure and lowered cost of capital

Case studies:

1. Umeme Limited

2012: Listed on the Uganda Securities Exchange, offering shares to the public at a price of Ugx 275

2014: Undertook a secondary offer and part of Umeme Holdings Limited, the majority shareholder, was offered to the public at Ugx 340

2016: By 30th September, share price was at Ugx 525

CAPITAL GAIN FROM 2012- 2016: 224% per share

2018: Since listing, share price has gone to a high of Ugx 550

2. British America Tobacco Uganda (BATU)

2000: Carried out an IPO at the share price of Ugx 1000

2016: By 30th September, share price was at Ugx 30,000

CAPITAL GAIN FROM 2012 –2016: 2,900% per share

Economic outlook of Uganda, as of 2018, by PwC

The Ugandan economy is expected to accelerate by 5% – 7% per year during 2018 – 2022

Currently, the economy is projected to grow by 5% – 5.5% this financial year of 2017/2018, thanks to:

a) Recovery in the private sector credit

b) Rebounding Foreign Direct Investment (FDI)

c) Sustained Government investment in infrastructure

d) Favorable weather conditions

All sectors of the Ugandan economy grew in the first quarter of the current financial year 2017/2018 compared to the same period last year, according to the Uganda Bureau of Statistics (UBOS).

a) The agricultural sector grew by 9% compared to a decline of 2% in 2016/17

b) The industry sector grew by 5% compared to 4.2% in 2016/17

c) The services sector:

- Information and Communication grew by 2.9%

- Financial services and Insurance grew by 2.6%

- Public Administration grew by 1.4%

- Education grew by 3.3%

- Health grew by 0.5%

The banking sector in Uganda

Banks are the main source of credit in Uganda therefore they have a direct impact on the level of expenditure and investment in the economy.

All banks are meeting the minimum core capital requirements 8% in risk weighted assets.

All banks also have adequate liquidity buffers. This is reflected by the ratio of their liquid assets to total deposits. The ration was an average 50.1% across the industry, as of June 2017.

Exciting Times Ahead?

The growing interest by locals in investing in stocks and the availability of requisite regulatory and market players capacity, make this an ideal time for the growth of the capital market in Uganda.

With CIPLA-QCIL ending the 6-year IPO dry-spell at the USE, it is a testament of growing confidence in the Uganda equity market and indicates that it is about time that more companies went the IPO way. In line with that, there has been a lot of urging by the locals in Uganda for the African Telecommunications giant, MTN, to float its shares on the Ugandan Stock Exchange to ensure that Ugandans who have grown with the company to get meaningful participation. If more IPOs are generated by Ugandan firms, it is indeed exciting times ahead for the Ugandan capital markets.

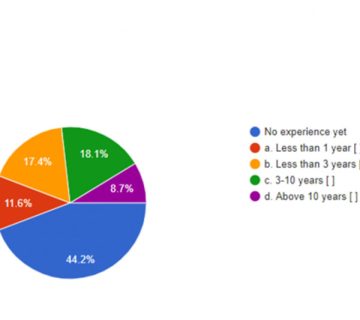

No comment