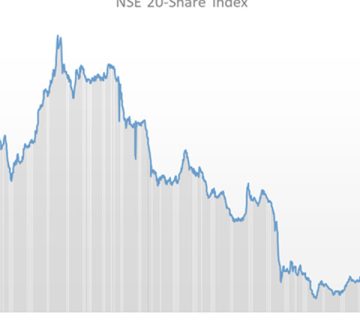

In 2016, the Kenyan parliament passed a bill capping interest rates in the country at 4% above the Central Bank Rate which at the time stood at 10%. This effectively meant that Kenyan banks were not allowed to charge interest rates more than 14%. This was a move that was widely celebrated as it meant that “Wanjiku” was able to access financing for projects easily. At least that is how it appeared on paper. In the one and a half years after enactment of the law, there has been witnessed different results from what was expected.

The immediate effect of the cap was the infringement of CBK’s independence. Success for an economy is hinged on a regulator who can enforce fiscal policies without external influence. The law was highly opposed by the CBK in the lead up to its signing. They indicated that it would inhibit economic dynamism and create rigidity in the financial system.

The biggest effect of the law went against the very spirit with which the law was supposedly written. The law was meant to make it possible to enable the small-scale borrowers access credit at affordable rates. With the passing of the law, there was an upsurge of the loan applications received by banks. It was reported that the increase was as high as by over 200%. This meant that the risk level of giving out loans increased substantially and naturally the loans that banks would give out reduced drastically.

Banks were willing to loan to low risk entities like large organizations and the government. This lead to financial exclusion of players in the MSME segment thus hurting the private sector and by and large the growth of the economy. It has been argued that the banks declined to support the government’s initiative or that the government did not provide the requisite risk mitigation support to the banks to make the policy success viable and sustainable.

With loan applicants locked out by banks, they turned to alternative lenders for funding for their financial needs. This has over time given the rise to lenders like shylocks who lend at exorbitant rates. These lenders took advantage of individuals who were desperate for funding. Loan applicants with shylocks have found themselves paying interest on loans above the interest that they would pay with the banks before the rate cap was put in place. The rate also gave rise to fintech companies, some of whom charge high interest rates to desperate borrowers. In some cases, the names of defaulting borrowers, who have no proven means to pay back the loans, have been given to Credit Reference Bureaus (CRBs) for blacklisting. It may seem like a noble idea to give the most needing individuals financing but if Financial Crisis of 2007-2008 taught us anything, it is lending to people unable to pay is a recipe for disaster.

In months following the interest rate capping was enacted, financial institutions reported a dip in their revenue. This was because loan book is the revenue driver for most of the institutions. The domino effect of this was that several banks were unable to retain the staff compliment like it could before. Yes, some of the job cuts were attributable to digitization of most banking services but the rate capping did not help. Massive layoffs have been reported in the banking industry, especially from the large banks. The layoffs also stretch into SMEs that are unable to get financing to service projects or growth plans.

The proposal in parliament to scrap the interest rate cap has initiated a huge debate on all media platforms with most of the industry players, from the regulator, to the national treasury, to the banks and industry associations, rooting for the repealing of the interest rate capping law. Repealing the interest cap law will result in a general increase in the cost of credit and so on the face of it seem costly to Kenyans. It will however reopen the opportunity for a wider range of MSMEs and individuals to access formal credit at a reasonable cost. This will hopefully result in the resurgence of growth within the MSME sector and by extension the economy.

Paul Kihiu

Business Development Director, C&R Group

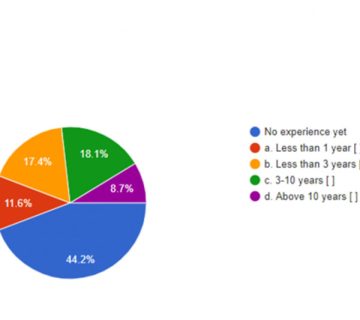

No comment